Accountants

Search

Accountants

Search

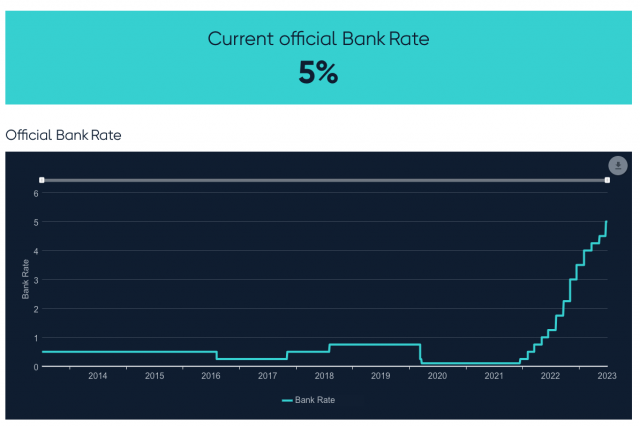

With the latest news revealing that the interest rates of fixed mortgage products have risen to a 12 year high.

The recent Corporation Tax U-turn has sent shockwaves throughout the business community.

Research and development, also known as R&D, matters for businesses serving all industry sectors. It’s the key to strengthening your organisation as a whole and fostering innovation from within to drive your business to new heights.

The official self-assessment tax return deadline for the 2020/2021 tax year may have been and gone, but leaving your accounts to chance and your next tax return submission to the last minute certainly isn’t recommended.

When running your business, it may often feel like there are not enough hours in the day! Whether you’re an organisation wanting to take the products or services you provide to a global audience

There’s a long list of benefits that go hand-in-hand with outsourcing to an accountant. Businesses and sole traders alike can enjoy improved cost effectiveness, access leading software, and work with accounting experts just like yourself to better understand their finances.

Whilst using an accountant to complete and submit your accounts for filing isn’t a legal requirement, doing just that unlocks a long list of benefits for businesses of all shapes and sizes.

When it comes to developing your business, every little (and big) tax relief helps.

Running your own business or working as a self-employed professional unlocks a long list of advantages.

In today’s technologically driven world, software plays a huge role in how we manage our businesses, especially when it comes to its finances.