Accountants

Search

Accountants

Search

With the latest news revealing that the interest rates of fixed mortgage products have risen to a 12 year high, it’s safe to say that the cost of living crisis is continuing to intensify, leaving many worried for the future. But what are the current mortgage rates and are they likely to decrease anytime soon?

The challenges caused by the cost of living crisis have added to the financial pressure experienced by borrowers based throughout the UK. Whether it’s the interest on credit card transactions or your current mortgage product, the Bank of England’s continuous hikes have caused much concern.

Interest rate rises in the mortgage sector are particularly concerning, with fresh inflation figures driving interest rates to new highs. According to Moneyfacts, the average two-year fixed mortgage product now has an interest rate of 6.23%.

Those willing to fix for longer, i.e. for a period of five years, will enjoy a slightly lower interest rate. On average, choosing a five-year fixed mortgage to finance your residential purchase or remortgage will incur an interest rate of 5.86%.

Like two-year fixed products, the new interest rate is the highest it has been since the release of the mini budget back in November 2022.

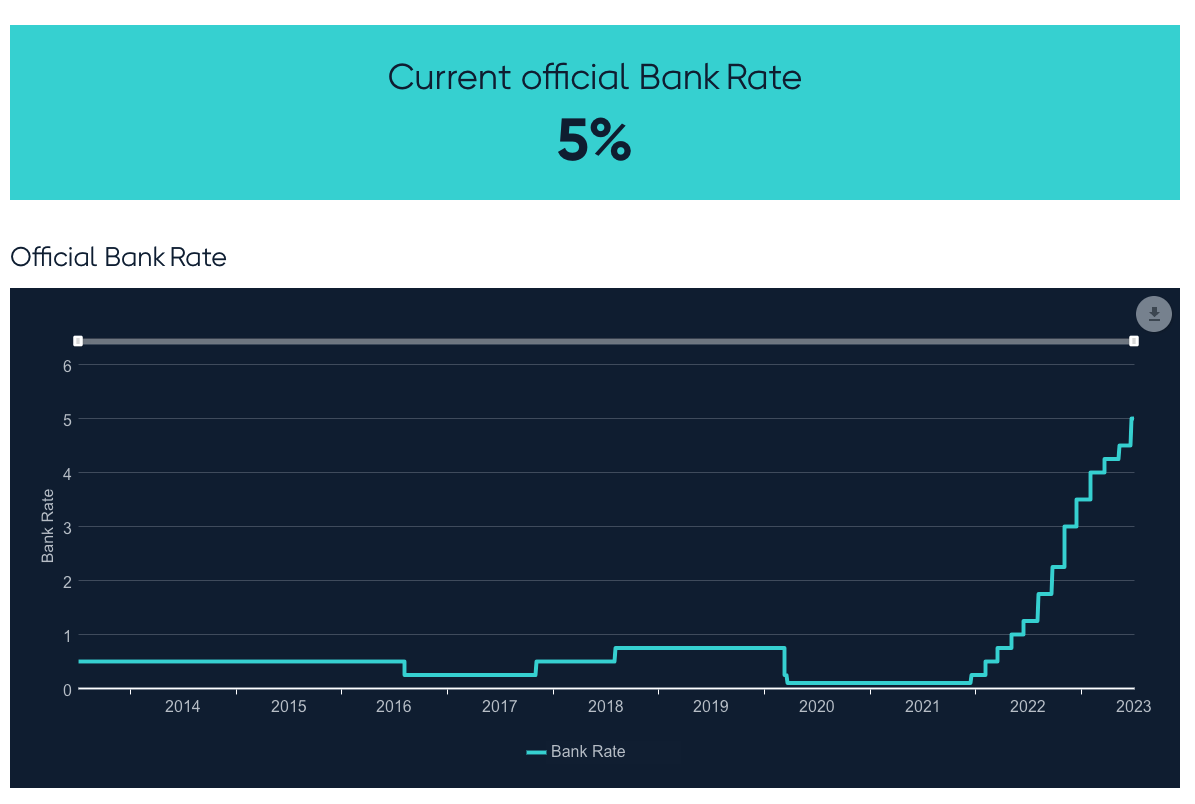

With the Bank of England’s Base Rate still expected to top out at around 6% next year following its recent lift by a half point to a 15-year high of 5%, mortgage rates aren’t expected to come down anytime soon.

It’s estimated that the Bank of England will continue to increase interest rates, and it’s a move that is already being pre-empted by mortgage lenders. With this in mind, mortgage rates are likely to be around 7.5%.

It’s not all doom and gloom though. Forecasters are still holding out hope that rates will begin to gradually fall over the next couple of years, with most describing the recent increase as “temporary”. It is expected that once inflation is back under control, the interest rates will be reduced to pre-pandemic levels.

In December 2021, the interest rate on the average two-year fixed residential mortgage stood at just 2.34%, while a five-year fixed deal was priced at 2.64%.

Don’t be tempted to fix for longer to take advantage of those more palatable five-year deals. Those who fix for the long term may come to regret it if interest rates fall to pre-pandemic levels as predicted.